Nevada Legal Press, newspaper, news, legal, legal newspaper, legal news, legal notice, legal ad, legal advertising, legal publication, publish a legal notice, publish a legal ad, publication, real estate, government, corporate kit, corporate kits, corporation kit, corporation kitsClark, Clark County, Nye, Nye County, County, Nye County Nevada, Nevada, Nye County Newspaper, Pahrump, Pahrump Valley, Las Vegas, North Las Vegas, Henderson, Boulder City, Bunkerville, Mt. Charleston, Jean, Primm, Laughlin, Nevada, Southern Nevada

Information Regarding ...

Limited Liability Companies

Limited Partnerships

Limited Liability Partnerships

Limited Liability Limited Partnerships

Business Trusts

Occasionally, we are asked if LLC's, LP's, LLP's, LLLP's & BT's (Business Trusts) are considered "types" or "forms" of corporations and, as such, are required by NRS 80.190 to publish a Statement of Business.

We, the Nevada Legal Press, are not permitted to offer legal advice on this matter. However, we can explain why we send notifications to these entities and certain other facts concerning the subject.

1. Black's Law Dictionary ... definition of a CORPORATION ...

An artificial person or legal entity created by or under the authority of the laws of a state or nation, composed, in some rare instances, of a single person and his successors, being the incumbents of a particular oltice, but ordinarily consisting of an association of numerous individuals, who subsist as a body politic under a special denomination, which is regarded In law as having a personality and existence distinct from that of its several members, and which is, by the same authority, vested with the capacity of continuous succession, irrespective of changes in its membership, either in perpetuity or for a limited term of years, and of acting as a unit or single individual in matters relating to the common purpose of the association, within the scope of the powers and authorities conferred upon such bodies by law. See Case of Sutton's Hospital, 10 Coke. 32; Dartmouth College v. Woodward, 4 Wheat. 518, 636, 657. 4 L. Ed. 629; U. S. v. Trinidad Coal Co., 137 U. S. 160, 11 Sup. Ct. 57. 34 L. Ed. 640; Andrews Bros. Co. v. Youngstown Coke Co., 86 Fed. 585, 30 C. C. A. 293; Porter v. Railroad Co., 76 111. 573; State v. Payne, 129 Mo. 468, 31 S. W. 797. 33 L. R. A. 576; Farmers' L. & T. Co. v. New York, 7 Hill (N. Y.) 2S3; State BL.LAW DICT.(2D ED.)

As LLC's, LP's, LLP's, LLLP's & BT's (Business Trusts) are "a legal entity created by or under the authority of the laws of a state or nation" they are considered "types" or "forms" of corporations and, as such, are required by NRS 80.190 to publish a Statement of Business.

2. There appears to be some controversy within the Nevada state government as to whether LLC's, LP's, LLP's, LLLP's & BT's (Business Trusts) are "types" or "forms" of corporations.

It appears that some state officials and some individuals within some state entities, departments, and agencies consider LLC's, LP's, LLP's, LLLP's & BT's (Business Trusts) as "types" or "forms" of corporations and that others do not.

When we call (by telephone) the various state agencies & departments involved we receive conflicting responses from various individuals. - Some say that LLC's, LP's, LLP's, LLLP's & BT's (Business Trusts) are "types" or "forms" of corporations and that others say that they are not. - When asked, none of these people will "put it in writing".

3. We have, in the past, requested an official Attorney General's Opinion on the matter. - However, no official opinion has been forthcoming.

We have, in the past, asked our state legislator to request an official Attorney General's Opinion on the matter. - To date, no opinion has been rendered.

It appears that, for whatever reason, the Attorney General either refuses to or prefers not to issue an opinion one way or the other.

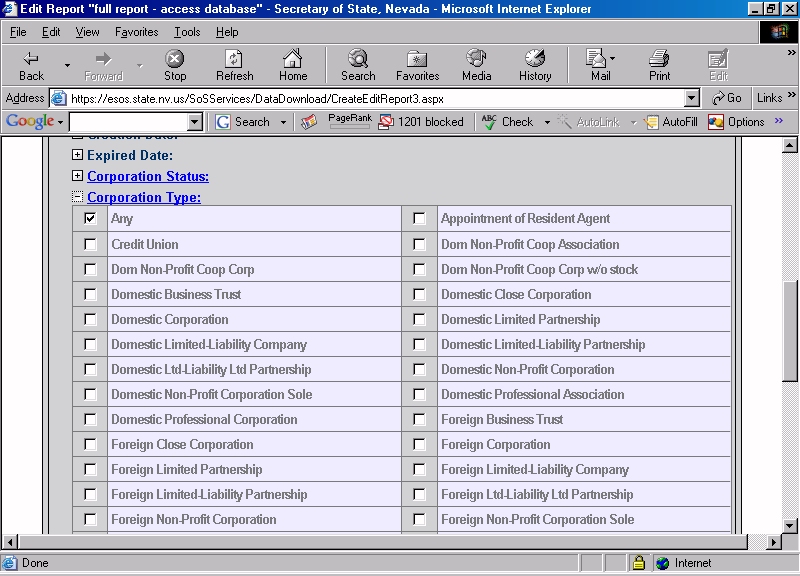

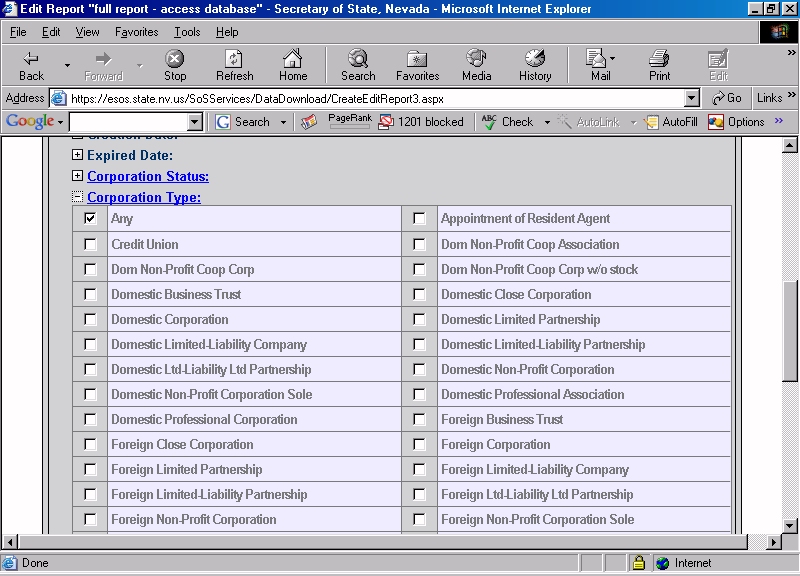

4. When we request, and pay for, a list of all foreign corporations from the Nevada Secretary of State we receive a list that includes LLC's, LP's, LLP's, LLLP's & BT's (Business Trusts) which indicates that the Nevada Secretary of State considers LLC's, LP's, LLP's, LLLP's & BT's (Business Trusts) forms or types of corporations.

5. We find on the Nevada Secretary of State's web site the following statement ...

.... making it abundantly clear that LLC's, LP's, LLP's, LLLP's & BT's (Business Trusts) are considered types of corporations.

6. The following is from Internal Revenue Service Publication 542 ...

Business formed after 1996. The following businesses formed after 1996 are taxed as corporations.

A business formed under a federal or state law that refers to it as a corporation, body corporate, or body politic.

A business formed under a state law that refers to it as a joint-stock company or joint-stock association.

An insurance company.

Certain banks.

A business wholly owned by a state or local government.

A business specifically required to be taxed as a corporation by the Internal Revenue Code (for example, certain publicly traded partnerships).

Certain foreign businesses.

Any other business that elects to be taxed as a corporation (for example, a limited liability company (LLC)) by filing Form 8832, Entity Classification Election. For more information, see the instructions for Form 8832.

7. The following is from Internal Revenue Service Publication - Frequently Asked Questions ...

Entities: Sole Proprietor, Partnership, Limited Liability Company/Partnership (LLC/LLP)

Question: For IRS purposes, how do I classify a domestic limited liability company? Is it a sole proprietorship, partnership or a corporation?

Answer: A domestic limited liability company (LLC) is an entity:

Formed under state law by filing articles of organization as an LLC.

Where none of the members of an LLC are personally liable for its debts.

Must be classified for Federal income tax purposes as if it were a sole proprietorship (referred to as an entity disregarded as separate from its owner), a partnership, or a corporation. However, if the LLC has employees, for employment tax purposes the LLC will be treated as a corporation.

In conclusion, although Nevada Legal Press does not have the authority or responsibility to state that LLC's, LP's, LLP's, LLLP's & BT's (Business Trusts) must publish an Annual Statement according to NRS 80.190, we feel that we should at least notify all foreign [to Nevada] entities of the law and allow each entity to form their own opinion.

back to home page

- All Rights Reserved -

The contents of the Nevada Legal Press

may not be re-published, resold, or reproduced in any

manner whatsoever, in whole or in part without the express written permission of the publisher.